Finance charge calculation methods in credit cards. When a fixed asset is sold or written off you need to calculate balancing allowance or balancing charge if capital allowance has been claimed for the asset previously.

Balancing charge and Balancing allowance.

. A balancing charge arises where the amount of the sale insurance salvage or compensation moneys received exceed the unused capital allowances in respect of the machinery or plant except other than where the machinery or plant is disposed of to a connected person where the amount of those moneys is less than 2000. For example 1800 plus 550 plus 1350 comes to 3700. The right-hand side of the equation should be roughly equal to the left-hand side.

You get 550. This is the balancing charge. If the assets termination value is more than its adjustable value include the difference in your assessable income.

How to calculate finance charges. The number printed on page TR 1 of your tax return the SA Helpline on 0300 200 3310. Example of a balancing charge.

Then for 15 days your balance was 90. Charge Balance-The sum of positive charges equals the sum of negative charges in solution Electroneutrality. A balancing allowance also called a capital allowance is the opposite of a balancing charge.

An adjustment known as a balancing charge may arise when you sell an asset give it away or stop using it in your business. If the value you deduct is more than the balance in the pool add the difference to your profit. Once you have a range of numbers spanning the complete billing cycle add all these numbers together.

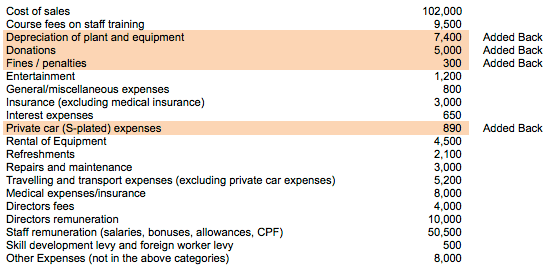

AA 80 x the cost of asset number of years of working life. Balancing charge 28400 Computation of chargeable income Adjusted income 120000 Add. What Is a Balancing Allowance.

Capital allowances bf 30000 Capital allowances on other assets 55000 85000 Statutory income Chargeable income 63400. You calculate the balancing adjustment amount by comparing the assets termination value for example the sale proceeds with its adjustable value the cost of the asset less depreciation deductions. Once you calculate and get a number add this amount to the taxable income increasing the amount of taxable profit.

Balancing allowance is tax deductible whereas Balancing charge is taxable income. While computing a companys Wear and Tear Allowance. If the balance is less than 4000 you will have a balancing charge equal to the difference between the balance and 4000.

You add this to your profits on your tax return. Finance charges are calculated by summing each days balance multiplied by the daily rate which is 1365th of your APR. Balancing charges are added to your taxable profits or are deducted from your losses in the year they occur.

To calculate the balancing charge add the amount you sold the item for to the capital allowances you claimed then subtract the amount you originally bought the item for. This is known as a balancing allowance. The rule says that you first need to calculate the periodic rate by dividing the nominal rate by the number of billing cycles in the year.

18000sales price 20000purchase price-4000capital allowance of last year. Since this is a addition benefit it would be taxable referred as Balancing Charge. 1 Sold the machine for 18000.

So we will calculate it as. This is a balancing charge. Balancing charge 28400 148400 Less.

2 Sold the machine for 10000. The number of years of working life is based on the Sixth Schedule of the Income Tax Act 1947 eg. The concentration of eitherprotons or hydroxide ions can usually be neglected because their.

Mary a driving instructor bought a car for her business six years ago for 11500. Then the balance gets multiplied by the period rate in order to have the corresponding amount of the finance charge. As this is more than the tax written down value you must add a balancing charge to your annual profit when you do your tax return.

Summary of the Different Methods to Claim Capital Allowances. Laptop sale price 500 capital allowances claimed 2000 minus the original laptop price 2000 500. Stated another way the daily rate is.

Protons and hydroxide ions are always present due to the dissociation of water. In this case as a company u would get a benefit of 2000 ie. Balancing charge Disposal Value Capital Allowance Purchase Price.

The daily balance method of calculating your finance charge uses the actual balance on each day of your billing cycle instead of an average of your balance throughout the billing cycle. Divide this number by the total number of days in your billing cycle. Demonstration of Balancing charge in binary ionic compounds.

The working life for motor vehicle is 6 years.

Pin On Chemistry What Is Chemistry

Balancing Of Chemical Reaction By Algebric Method Chemical Chemical Reactions Reactions

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

Balancing Adjustments On Pools And Review Of Capital Allowance Computation Acca Taxation Tx Uk Youtube

Balancing Charge Or Balancing Allowances

Atoms Lesson Plan A Complete Science Lesson Using The 5e Method Of Instruction Teaching Chemistry Science Lessons Chemistry Lesson Plans

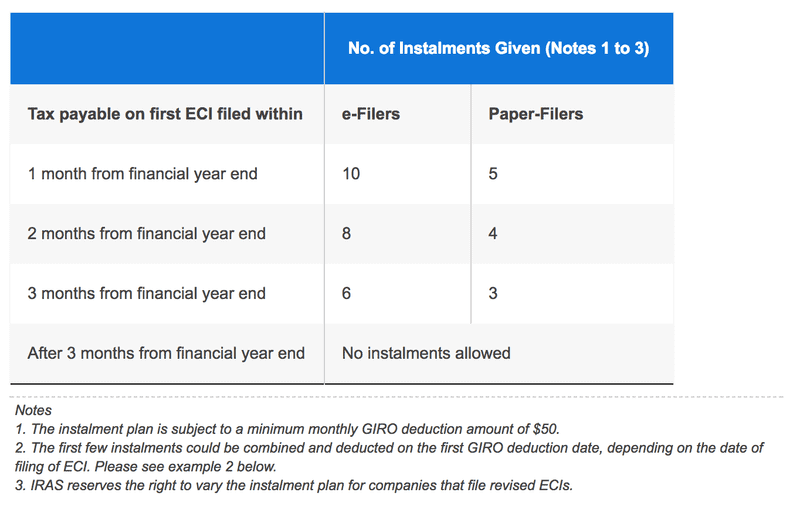

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

Solved The Following Is The Information Regarding Maya Enterprise Compute The Amount Of Capital Allowance Balancing Allowance Or Balancing Charge Course Hero

Bill Manager Spreadsheet Bill Of Lading Bill Template Budget Spreadsheet

Balancing Adjustments On Pools And Review Of Capital Allowance Computation Acca Taxation Tx Uk Youtube

P Cl Pcl Balanced Eq Phosphorus Chlorine Gas To Form Phosphorus Pentachloride Balanced Equation Youtube Balance Phosphorus Equation

Lewis Structures Introduction Formal Charge Molecular Geometry Resonance Polar Or Nonpolar Youtube Molecular Geometry Molecular Chemistry

Plus Two Accountancy Notes Chapter 1 Accounting For Not For Profit Organisation A Plus Topper Learn Accounting Accounting Principles Accounting

Solved The Following Is The Information Regarding Maya Enterprise Compute The Amount Of Capital Allowance Balancing Allowance Or Balancing Charge Course Hero

Chapter 4 Types Of Cost And Cost Behaviour

7 Steps To Calculating Estimated Chargeable Income Eci Tinkertax

Balance A Redox Reaction Basic Solution Redox Reactions Ap Chemistry Chemistry

Answer Key For The Balance Chemical Equations Worksheet Balancing Equations Chemical Equation Balancing Equations Chemistry